Driving a car or riding a motorcycle you own

It is said that Japan is a safe country, but more than 43 thousand traffic accidents result in bodily injury a year(2018).

As traffic rules are different from other countries, drive in Japan may be a little frightening.

Automobile insurance in Japan basically consists of two types: “Compulsory Automobile Liability Insurance (CALI)” and “Voluntary Automobile Insurance”.

Anyone found driving a vehicle without CALI is fined heavily.

It is mandatory for all vehicles to have CALI, so you will need it when you purchase a car.

In addition to CALI, we strongly recommend purchasing voluntary automobile insurance to cover any damage that exceeds the maximum amount covered by CALI, if you’re involved in an accident.

If You Are Given a Car by a Friend

If you get a car from a friend, it is necessary to confirm whether or not it is covered by CALI.

If not, you have to enroll it in the CALI system.

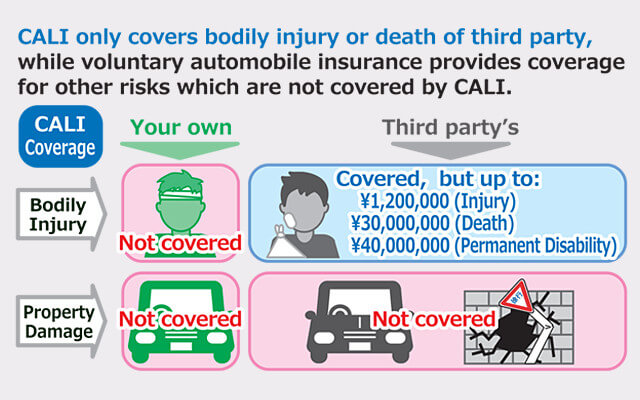

What is Compulsory Automobile Liability Insurance (CALI)?

CALI was established by the government with the ultimate purpose of affording redress to victims of traffic accidents.

Therefore, there is no difference in coverage and premium rates among general insurance companies.

Coverage

CALI ONLY covers injury or death of a third party in a traffic accident.

Your vehicle and those of other parties, and your injuries, etc. are not covered.

Insurer Liability Limits

The limits of an insurer’s liability are individually applied to victims.

- Death:30 million yen

- Injury:1.2 million yen

- Permanent disability:750,000 yen to 40 million yen, depending on the grade of permanent disability (based on severity).

※Please note that the explanations about the general insurance referred above are based on the Japanese laws and practices. Please also note that the explanations referred above are examples.

Actually, they may vary depending on each circumstance.

What is voluntary automobile insurance?

Generally, most general insurance companies provide insurances such as the following.

Coverage

- Voluntary automobile insurance includes various types of cover such as bodily injury liability coverage which pays for liability exceeding the maximum amount covered by CALI, property damage liability coverage, personal injury protection, and damage to own vehicle coverage, etc.

- Voluntary automobile insurance is composed of the above types of coverage.

- As coverage details vary between general insurance companies, please check to find the policy most suitable for you.

Third-party Liability Coverage

Bodily Injury Liability Coverage

Bodily injury liability coverage is a basic form of cover typical of an automobile insurance policy.

This insurance covers the medical expenses and lost wages etc. of injured third-party, if the insured is found to be at fault.

This coverage pays for liability exceeding the maximum amount covered by Compulsory Automobile Liability Insurance (CALI).

Property Damage Liability Coverage

If the insured is found to be at fault, this insurance covers the repairs or replacement costs of damaged cars and other property.

※There was a recent case where the driver at fault in a traffic accident paid about 530 million yen in bodily injury damages, and about 260 million yen for property damage.

Therefore, we strongly recommend that the amount of bodily injury liability insurance and property damage liability insurance be set as unlimited.

Coverage for Yourself

Personal Injury Protection

Regardless of who is at fault, personal injury protection can help cover a total loss, including lost wages and medical expenses, etc. for you and your passengers after an accident.

Passengers’ Personal Accident Coverage

Compared to “Personal Injury Protection”, this coverage pays a certain amount of loss if the driver or passengers of the insured vehicle are injured in an accident.

Coverage for Personal Accident Caused by the Insured

This coverage pays when the driver or passengers die or are injured in an accident caused by a driver that is not covered by CALI (such as a collision with a utility pole due to a driving error).

Uninsured Motorist Coverage

This coverage pays when the driver or passengers die or suffer permanent disability by the following cases:

- Being hit by an automobile that is not insured against bodily injury liability.

- Being hit by an automobile whose driver does not have sufficient means to pay the damages.

- Being hit-and-run and the person as fault can not be identified.

Damage to Own Vehicle (Collision and Comprehensive) Coverage

This coverage pays for accidental damage to your vehicle.

General vehicle damage coverage, and coverage for limited perils with affordable premiums are available.

- Collision

- Fire, explosion

- Typhoon, flood, tidal wave

- Theft

- Self-incurred accident (※)

- Hit-and-run (※)

※In general, the coverage for limited perils with affordable premiums does not cover self-incurred accident and hit-and-run.

Discounts

Classified Rating System

For automobile insurance, a classified rating system is used, which means that the grade of the policyholder goes up or down depending on his/her accident history during the policy period.

"His/Her premium for the following year will decrease or increase accordingly."

Driver’s Age Limit Restrictions

When purchasing an automobile insurance policy, a premium discount is available if a condition to restrict the age of the driver is added.

Discount for a Vehicle Driven by the Policyholder and Family Members Only

This system offers a discount on premiums to the policyholder who limits the driver of the insured vehicle to the policyholder and his/her family members.

However, policies issued under this discount system do not cover any accidents caused by drivers who are not family members of the policyholder.

※Please note that the explanations about the general insurance referred above are based on the Japanese laws and practices. Please also note that the explanations referred above are examples.

Actually, they may vary depending on each circumstance.